Stock Market: The Need for Public Awareness!

By Dr. Dharmendra Mulherkar

Published on July 13, 2025

In today’s modern economic era, every individual urgently needs financial literacy. Concepts such as employment, savings, insurance, loans, and investments are no longer confined to economists alone. One of the most impactful aspects of these is the stock market. However, in India, a majority of people still harbor ignorance, fear, misconceptions, and apathy toward the stock market. Therefore, disseminating accurate information and raising awareness about the stock market in society is the pressing need of the hour.

In simple terms, the stock market is a platform where companies make portions of their ownership—known as shares—available for purchase by ordinary citizens. The buying and selling of these shares occur under specific regulations in government-approved exchanges, such as the NSE (National Stock Exchange) and BSE (Bombay Stock Exchange). Investors put in their money, and depending on the company’s performance, they reap profits or incur losses.

Unfortunately, ordinary people in both rural and urban areas continue to view this concept as ‘gambling,’ a ‘shortcut to wealth,’ or even ‘fraud.’ This mindset stems primarily from inadequate information, superstitions, and rumors. Some individuals invest in shares based on partial knowledge and, upon suffering losses, blame the entire market. To prevent this, financial education and proper guidance are absolutely essential.

Investing in the stock market with proper planning, discipline, and patience can lead to long-term financial stability. Today, accessible and transparent options like SIP (Systematic Investment Plan), mutual funds, ETFs (Exchange-Traded Funds), and index funds make it possible for even the average person to invest safely in the stock market.

For instance, an SIP can be started with as little as ₹500 per month. This opens up avenues for financial progress to citizens from lower economic strata as well. However, directional advice and financial discipline are indispensable for success.

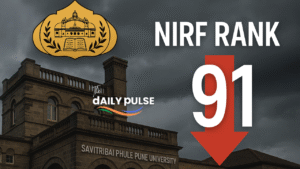

From the standpoint of public education, schools, colleges, gram panchayat offices, and voluntary organizations must foster awareness about the stock market among the masses. It is essential to organize workshops, online webinars, and create guidebooks in the Marathi language. Local self-government bodies should educate citizens on the opportunities and risks in the market as part of broader financial literacy initiatives.

The stock market is not merely a tool for the wealthy; it is also a pathway to financial independence accessible to the common person. Every endeavor is built on information, education, and experience. Thus, by leveraging clear information about the stock market, adopting a long-term perspective, and practicing discipline, we can effectively confront future financial challenges.

In conclusion, we must recognize that the stock market is not gambling but a tool for economic advancement grounded in information in this digital age. If we aim to build a financially self-reliant India, opportunities like the stock market must be extended to every ordinary citizen.

About the Author:

Dr. Dharmendra Mulherkar

M.Com, MA (Communication & Economics), MBA (Finance), Ph.D. in Commerce

An author with extensive experience in educational and administrative fields. Special interest in research on financial literacy and rural development.

#StockMarket #FinancialLiteracy #InvestmentTips #ShareMarket #SIP #MutualFunds #ETF #IndexFunds #EconomicAwareness #SelfReliantIndia #FinanceEducation #RuralFinance #WealthBuilding #IndiaInvesting

टिप्पणी पोस्ट करा